All Categories

Featured

Table of Contents

Selecting to spend in the genuine estate market, supplies, or other conventional kinds of properties is sensible. When making a decision whether you ought to purchase certified investor possibilities, you need to stabilize the trade-off you make between higher-reward prospective with the lack of reporting needs or regulative openness. It should be claimed that exclusive placements entail higher degrees of danger and can frequently stand for illiquid investments.

Particularly, nothing below needs to be analyzed to state or indicate that previous results are an indicator of future performance nor should it be analyzed that FINRA, the SEC or any other securities regulator accepts of any of these protections. In addition, when examining private placements from enrollers or business using them to accredited financiers, they can offer no service warranties expressed or indicated regarding accuracy, efficiency, or results obtained from any kind of details provided in their conversations or discussions.

The business must supply details to you via a file called the Private Positioning Memorandum (PPM) that uses a much more comprehensive explanation of expenditures and risks related to taking part in the financial investment. Rate of interests in these bargains are just supplied to individuals who qualify as Accredited Investors under the Securities Act, and a as specified in Section 2(a)( 51 )(A) under the Company Act or a qualified staff member of the administration business.

There will not be any kind of public market for the Rate of interests.

Back in the 1990s and early 2000s, hedge funds were understood for their market-beating efficiencies. Typically, the manager of an investment fund will certainly set aside a portion of their available possessions for a hedged bet.

Residential Real Estate For Accredited Investors

A fund supervisor for an intermittent field might commit a section of the assets to supplies in a non-cyclical sector to offset the losses in situation the economy tanks. Some hedge fund managers use riskier methods like utilizing obtained money to purchase more of an asset simply to multiply their potential returns.

Comparable to common funds, hedge funds are skillfully managed by job capitalists. Unlike shared funds, hedge funds are not as purely controlled by the SEC. This is why they undergo much less analysis. Hedge funds can apply to different investments like shorts, alternatives, and by-products. They can likewise make different financial investments.

How much do Private Real Estate Deals For Accredited Investors options typically cost?

You might select one whose investment viewpoint straightens with your own. Do remember that these hedge fund cash supervisors do not come cheap. Hedge funds typically charge a fee of 1% to 2% of the properties, in enhancement to 20% of the profits which works as a "performance fee".

You can buy a property and obtain compensated for holding onto it. Approved financiers have much more possibilities than retail investors with high-yield investments and past.

Is Real Estate Investment Funds For Accredited Investors worth it for accredited investors?

You must meet at the very least among the following specifications to become a recognized financier: You have to have over $1 million web worth, excluding your main residence. Organization entities count as recognized investors if they have more than $5 million in properties under monitoring. You have to have a yearly revenue that goes beyond $200,000/ yr ($300,000/ year for companions filing with each other) You must be a registered investment advisor or broker.

As a result, accredited capitalists have a lot more experience and cash to spread out across possessions. The majority of financiers underperform the market, including recognized investors.

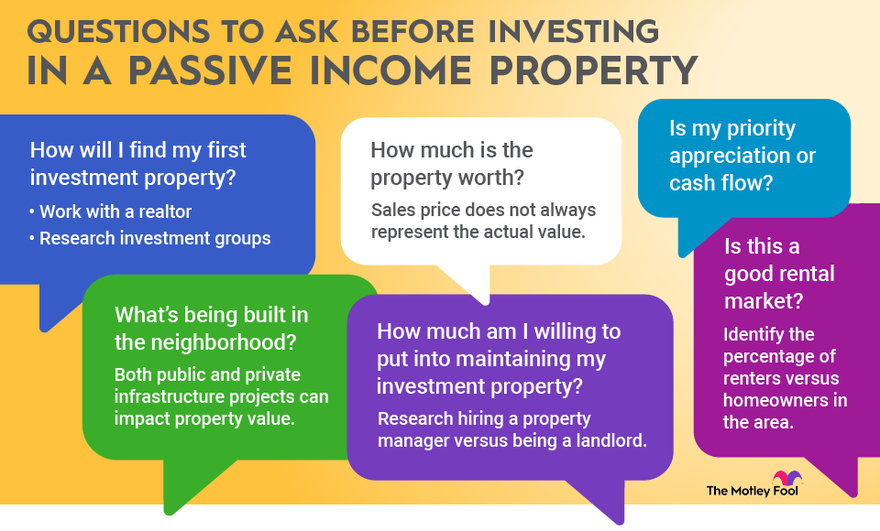

Crowdfunding gives recognized investors a passive role. Property investing can aid replace your earnings or cause a quicker retired life. In addition, financiers can build equity via favorable capital and residential or commercial property admiration. Real estate buildings need considerable maintenance, and a lot can go incorrect if you do not have the best group.

Who offers flexible Real Estate Development Opportunities For Accredited Investors options?

Real estate organizations pool cash from certified investors to purchase residential properties lined up with established purposes. Approved capitalists merge their money with each other to fund acquisitions and residential or commercial property development.

Real estate financial investment counts on need to disperse 90% of their taxable earnings to shareholders as dividends. REITs allow capitalists to expand rapidly throughout lots of residential or commercial property courses with extremely little resources.

Real Estate Syndication For Accredited Investors

Capitalists will certainly profit if the stock price increases considering that convertible financial investments offer them more appealing access factors. If the stock tumbles, investors can choose versus the conversion and shield their funds.

Latest Posts

How long does a typical Real Estate Investing For Accredited Investors investment last?

Tax Seizures Auctions

Sec In Rule 501 Of Regulation D